FinTech Market Size, Digital Innovation Trends, and Growth Forecast 2026–2034

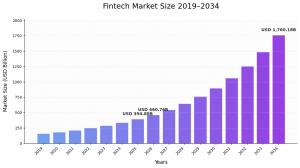

FinTech Market Size to Reach USD 1,760.18 Billion by 2034 from USD 460.76 Billion in 2026, exhibiting a CAGR of 18.20%

North America dominated the global market with a share of 32.30% in 2025”

NY, UNITED STATES, February 10, 2026 /EINPresswire.com/ -- The global finTech market demonstrated significant value at USD 394.88 billion during 2025. Market projections indicate expansion to USD 460.76 billion in 2026, with forecasts suggesting the sector will achieve USD 1,760.18 billion by 2034. This represents a compound annual growth rate of 18.20% throughout the forecast timeframe. Regional analysis reveals North America commanding a dominant position with 32.30% market share in 2025.— Fortune Business Insights

Financial technology enterprises deliver diverse services encompassing payment processing, peer-to-peer lending platforms, fraud detection systems, and blockchain technology solutions. The analysis encompasses offerings from prominent industry participants including Rapyd Financial Network, Unicorn Payment, Stripe, Mastercard, and Fiserv.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/fintech-market-108641

Technology Integration and Digital Transformation

Open banking emergence coupled with Application Programming Interface utilization facilitates collaboration between financial technology firms and established financial institutions. This partnership framework enables newer companies to utilize traditional banking infrastructure and data resources while developing innovative solutions and enhancing customer experiences.

The pandemic accelerated digital transformation within financial services significantly. Organizations and consumers increasingly adopted online and mobile banking platforms, generating heightened demand for financial technology solutions. Companies providing payment and transaction processing experienced substantial demand surges as electronic commerce, contactless payments, and digital wallets gained prominence during pandemic conditions.

Key Market Drivers

Artificial intelligence and machine learning integration represents a crucial growth catalyst. Financial technology providers incorporate these technologies to enhance fraud detection capabilities, customer service operations, credit scoring mechanisms, and personalization of financial services. This technological integration enables faster, more intelligent, and intuitive financial interactions while meeting customer expectations with higher satisfaction levels.

Cloud computing adoption optimizes operations substantially, driving market expansion. Cloud services provide scalable infrastructure that accommodates demand fluctuations in user activity and transaction volumes. The pay-as-you-go model enables effective cost management while reducing upfront infrastructure investments. Cloud technology flexibility enables rapid development, deployment, and iteration of solutions, proving essential in a fast-paced industry prioritizing innovation.

Additionally, real-time payment demand continues rising as providers deliver solutions enabling instant, cross-border, and secure transactions. Enhanced cybersecurity measures are being developed to protect financial data and transactions as digital financial activities increase.

Market Segmentation Insights

Technology Categories

Blockchain technology commands the largest segment share at 38.40% in 2026, attributed to its highly secure and immutable ledger characteristics. This technology makes unauthorized data alteration extremely difficult, enhancing transaction security and reducing fraud risks. Transaction transparency and real-time auditability build trust among participants and regulators.

The artificial intelligence segment demonstrates the highest projected growth rate during the forecast period. AI-powered chatbots and virtual assistants deliver instant, efficient customer support while quickly identifying and flagging potentially fraudulent activities.

Application Areas

Fraud monitoring represents the dominant application segment with 45.28% market share in 2026. Solutions offer real-time financial transaction monitoring, enabling immediate detection of suspicious activities and anomalies. Advanced analytics and machine learning algorithms identify patterns and trends associated with fraudulent activities, enhancing detection accuracy.

Know Your Customer verification applications exhibit the highest anticipated growth rate. These solutions automate verification processes, reducing manual work requirements and associated errors while validating customer information against various data sources.

End-Use Sectors

Banking institutions dominate with 36.90% market share in 2026, as banks can onboard new customers efficiently, reducing account setup time and effort. Market participants significantly integrate with financial technology-enabled banks to offer modern digital payment solutions, including mobile wallets and contactless payment options.

Financial institutions segment demonstrates the highest projected expansion rate, benefiting from data analytics and insights that facilitate data-driven decision-making and service improvements.

Regional Market Dynamics

North America maintains market leadership with USD 127.52 billion market size in 2025, particularly driven by Silicon Valley's role as a global financial technology innovation center. The United States market alone projects reaching USD 99.82 billion by 2026. Growing customization needs, regulatory compliance requirements, cross-selling opportunities, and industry trends drive regional growth.

The Asia Pacific region anticipates the highest growth rate during the forecast period. Financial technology services expand access to products and services, particularly in underserved and unbanked areas. Countries including China, South Korea, Japan, and India represent mobile-first markets where financial technology services capitalize on high mobile penetration rates. Regional analysis suggests Asia Pacific will overtake the United States to become the world's largest market by 2032.

Europe benefits from robust regulatory environments, with financial technology providers offering built-in regulatory technology features ensuring compliance with complex financial regulations. The United Kingdom leads regional investment in financial technology solutions.

Click for an Enquiry: https://www.fortunebusinessinsights.com/enquiry/book-a-call/fintech-market-108641

Market Challenges

Data privacy and security concerns present notable market restraints. Financial technology companies collect and process personal and financial data, making data privacy assurance and regulatory compliance challenging. These firms handle sensitive financial information, making them attractive targets for cyber-attacks with potentially severe financial and reputational consequences.

Building customer trust remains vital in the financial sector. Companies face skepticism from customers accustomed to traditional financial institutions, which may restrict market growth trajectories.

Competitive Landscape and Strategic Developments

Leading companies emphasize geographical expansion globally through industry-specific solution introduction. Strategic acquisitions and collaborations with local players strengthen regional market positions. Key participants introduce new products to attract customers and maintain their customer base while investing consistently in research and product development.

Recent industry developments include FIS launching the Fintech Hangout Series initiative to promote and connect startups, professionals, financial institutions, and investors. Finastra introduced compliance-as-a-service for banks operating in the United States and Europe. Adyen launched payout services enabling businesses to transfer funds through preferred methods. Strategic partnerships continue forming, such as Rapyd's collaboration with Belvo to enable uninterrupted open finance experiences in Latin America.

Read More Research Reports:

Automotive Fintech Market Size, Share & COVID-19 Impact Analysis

FinTech Blockchain Market Size, Share & Industry Analysis

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.